“When people think of the projects in Iskandar Malaysia, they do not usually think in terms of the flagship zones, which have different selling points.”

Focus on Iskandar flagship zones

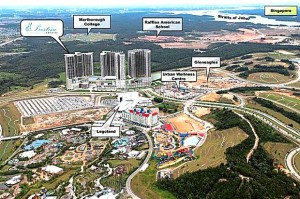

Artist impression of MCT Consortium Bhd’s mixed development in Nusajaya called d’Pristine @ Medini superimposed onto an aerial view of the current Medini development.

ISKANDAR Malaysia has always been the influencing factor in Johor property, but Klang Valley-based developer MCT Consortium Bhd believes it’s time buyers and investors zoomed into the different flagship zones and look at what each has to offer.

Iskandar Malaysia has five flagship zones, two of which are now inundated with upcoming property developments and catalytic government plans to develop the regional socio-economic hub.

“When people think of the projects in Iskandar Malaysia, they do not usually think in terms of the flagship zones, which have different selling points,” executive director Datuk Soo Kai Chee says.

He says although Iskandar Malaysia is a market of its own, differentiated from the surrounding areas not marked for metropolitan development, within itself are flagship zones with different master-plans at different progress levels.

“Perhaps because Iskandar Malaysia property projects have been largely marketed to attract Singaporeans, hence many Malaysians are less familiar with the masterplans for each zones and perceive Iskandar Malaysia as a singular property market,” he says.

Soo drew attention to Nusajaya in Flagship B, where the company is managing 8.42-acre mixed development in Nusajaya called d’Pristine @ Medini. The project is sited on the northern corner of Medini, the area designated to be the central business district (CBD) of Nusajaya.

“If you visit Medini now, there is not a single completed project.

“However, the Government has planned Nusajaya very well; they started with the non-property industries,” he says of the under-served residential property market.

There are six service and light industries – creative arts and entertainment, medical facilities, educational institutions, tourism, biotechnology and hi-tech manufacturing.

Now that some of the projects like the EduCity, Pinewood Iskandar Malaysia Studios, some healthcare components and theme parks have started operating, Soo notes that the Iskandar Regional Development Authority has created a great demand for property, most of which will be ready in a couple of years.

According to Iskandar Malaysia’s website, Nusajaya has 24,000 acres of contiguous development-ready land, and is one of the largest property development in South-East Asia.

Flagship B will be a major new growth centre of Iskandar Malaysia where most of the catalyst projects will be developed. The projected population size for this area by 2025 is 500,000, according to the website.

In Nusajaya itself, job opportunities should hit 88,430 within the next five to eight years, according to data compiled by MCT.

This is bolstered by other major developments in Nusajaya, such as the Southern Industrial & Logistics Cluster, Motorsports City @ Gerbang Nusajaya, Huawei Data Hosting and Logistic Centre, UEM Group’s China Wholesale Mall @ Asian Trade Centre, Puteri Harbour, Afiat Healthpark and Kota Iskandar.

“Now, most employees in the new service industries have to stay further away in Bukit Indah. Many of them come from other states or are expatriates, and we know that they, especially the foreigners, prefer to stay in higher-end residentials within the CBD,” Soo says.

He says Bukit Indah’s Klang Valley counterpart would be Puchong or Cheras.

On whether he feels competition from Chinese developers coming into Johor, Soo says they were not competing within the same flagship zone as most of them are in Johor Baru, which is Flagship A.

MCT in Nusajaya

MCT’s development in Medini is a near replica of the third phase in its flagship mixed development in USJ Subang called OneCity.

Like that phase, d’Pristine @ Medini will integrate two blocks of small office flexible offices (SoFos), an office block, a hotel and a mall as the base of all these components.

With a gross development value of RM850mil, d’Pristine is strategically sited across the road from the entrance of the Legoland theme park, and will be a stone’s throw away from other facilities under construction, like Gleneagles, Afiniti urban wellness centre by Khazanah Nasional Bhd and Singapore’s Temasek Holdings (Pvt) Ltd, and a transportation hub which is being planned.

At the back of the project is a lake and linear park that will be managed by the authorities.

The SoFos are already 70% sold, with 60% of the buyers from Singapore and some from Taiwan and Japan.

“We have plans to manage the SoFos as well, to help our investors, especially those overseas, manage their units here,” he says.

About 1,265 SoFo units in d’Pristine are priced between RM600 and RM800 per sq ft. In the Flagship A property market, similar properties are going at over RM1,000 per sq ft.

The units range from one-room at 644 sq ft to 3+1 rooms at 1,416 sq ft.

As for the 32-storey Grade A offices, the group is considering selling en bloc or floor by floor, depending on the demand.

“Many Singaporean companies or multinationals are prepared to relocate their back-end offices to Medini, while still having their headquarters in Singapore for the address.

MCT will retain the mall and four-star hotel for ownership and recurring income. “We want to show our buyers our commitment by maintaining our ownership so that we will have a say in the whole project,” Soo says.

The three-storey mall will have about 460,000 sq ft of net lettable space while the hotel is designed with 300 rooms.

Although plans for the hotel are not finalised, Soo says it would likely be managed by MCT.

Target for completion of the d’Pristine project will be in late-2017 or early 2018.

MCT will be listed via a reverse take-over of GW Plastics Holdings Bhd. The property group is in the process of finalising its audited interim financials for the purpose of inclusion into the circular for the proposed regularisation plan, which it had resubmitted to the Securities Commission last week.

The corporate exercise could be completed by the last quarter this year.

Read more here (The Star Online 28/6/2014)